Between Friday, March 10 and Monday, March 13, the second and third largest US Bank failures occurred, #2 Silicon Valley Bank (SVB) and #3 Signature Bank, arising from the Fed’s rapid rise in interest rates which dramatically reduced the value of all banks long term investment bonds / notes. These bank failures resulted in a flight to safety by investors to US Treasuries and drove down their interest rates. The odd beneficiary was the 30 year fixed rate mortgage which fell from 7% on Friday to 6.57% on Monday. Rates rose Tuesday, March,14, to 6.75% as the banking crises eased ( Mortgagee rates per Mortgage News Daily).

Federal Reserve conundrum: Keep fighting inflation by increasing rates and possibly generating more bank failures or backing off on their rate increases for now. The Consumer Price Index today was up 0.5% in February and 6% for the year. The Federal Reserve’s goal of 2% inflation.

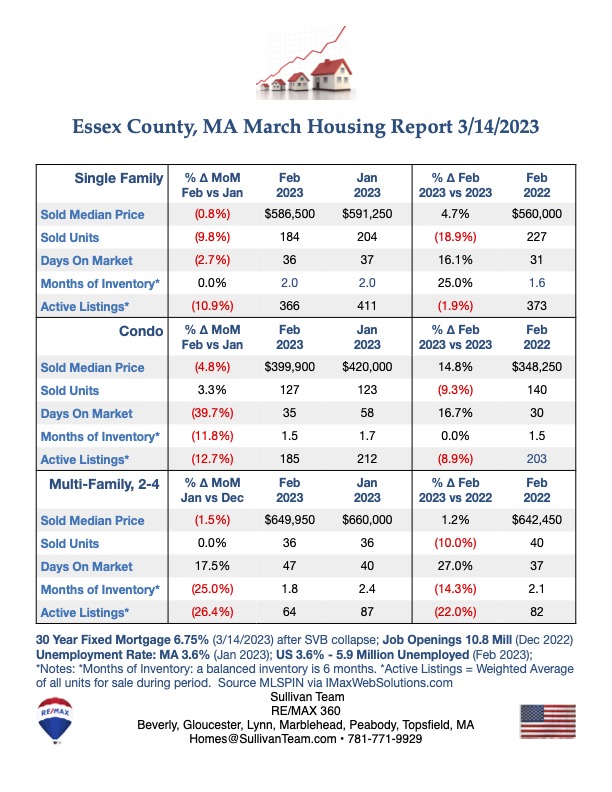

Today’s Bottom Line for Singles, Condos and Multies:

Units Sales and Active Listings continue to fall both year over year and month over month as mortgage rates rise. Prices softened from Jan to Feb.

- To view data for every Essex County town, http://www.sullivanteam.com/Properties/Reports/Public/Charts.php

- To Download the full housing report go to: http://sullivanteam.com/pages/EssexCountyHousingReports