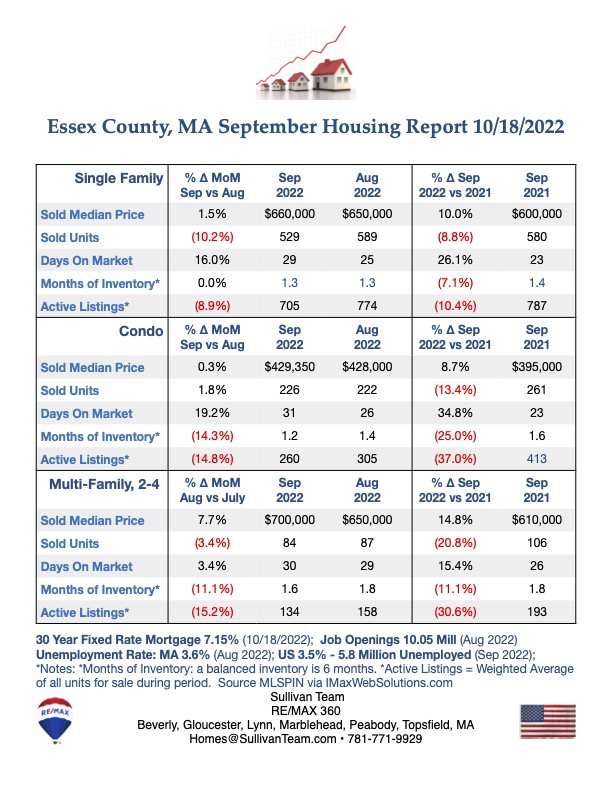

Essex County September Housing Report 10/18/2022

The Federal Reserve’s war on inflation is dampening real estate sales as the Fed continues to raise interest rates and reduce its purchase of Mortgage Backed Securities to fight inflation. After the last CPI Report which was a surprisingly high 8.2% inflation rate on 9/13/2022, the 30 year mortgage rate rose to 7.16% and the 10 year Treasury Notes rose to 4% on 9/14/2022.

Units Sales and Active Listings continue to fall and days on market are now rising in response to rising mortgage rates. Price increases are slowing.

Bottom Line:

Inventory will remain low as high mortgage rates deter home sellers with low mortgage rates from listing their homes. At the same time, buyers are resisting rising prices because of high mortgage rates / affordability. Hence, prices will continue to flatten or turn negative as sellers and buyers try to reach an equilibrium.

Month Over Month, September 2022 vs August 2022

-

Median Sold Prices:

Single Families +1.5%; Condos +0.3%; Multi-Families +7.7%

-

Unit Sales:

Single Families -10.2%, Condos +1.8%, Multi-Families -3.4%

-

Active Listings:

Single Families -8.9%, Condos -14.8%, Multi-Families -15.2%

-

Current Months of Inventory:

Single Families 1.3, Condos 1.2, Multi-Families 1.6.

Year Over Year, September 2022 vs September 2021

-

Median Sold Prices:

Single Families +10.0%; Condos +8.7%; Multi-Families +14.8% -

Unit Sales:

Single Families -8.8% , Condos -13.4%, Multi-Families -20.8%. -

Active Listings:

Single Families -10.4%; Condos -37.0%; Multi-Families -30.6% -

Change in Months of Inventory:

Single Families -7.1%, Condos -25.0%, Multi-Families -11.1%.

- To view data for every Essex County town, go to: http://www.sullivanteam.com/Properties/Reports/Public/Charts.php

- To Download the full housing report go to: http://sullivanteam.com/pages/EssexCountyHousingReports